Gulfood

17 To 21 FEB 2025 | DUBAI WORLD TRADE CENTRE

We’re excited to see you at Gulfood 2025!

Gulfood

17 To 21 FEB 2025 | DUBAI WORLD TRADE CENTRE

We’re excited to see you at Gulfood 2025!

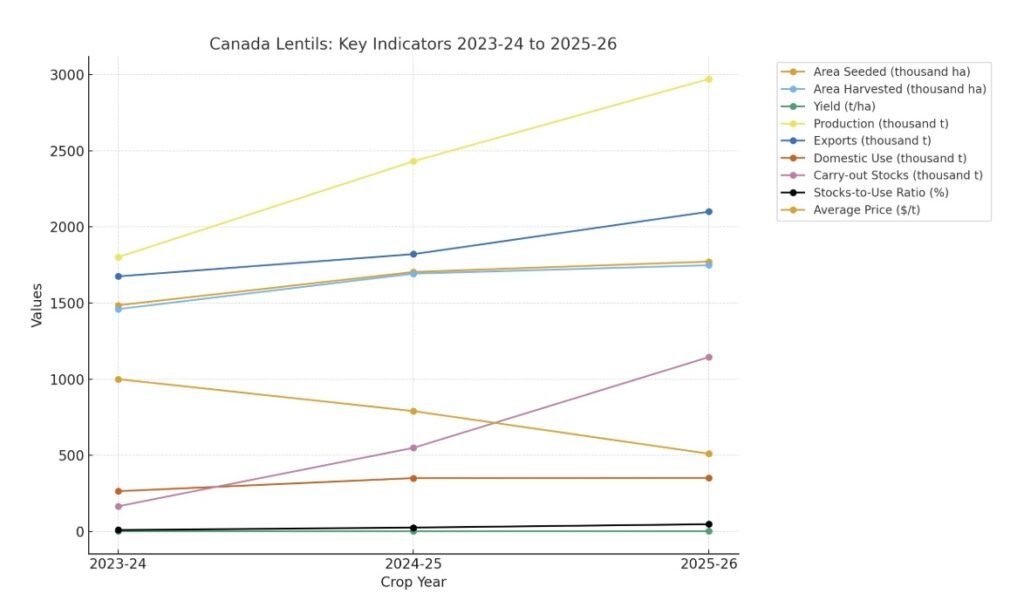

Canadian lentils are at the heart of our work at Lord Agro Trade. We stay closely connected to the Canadian crop market and rely on trusted reports from AAFC and Statistics Canada to share the latest insights.

Overview

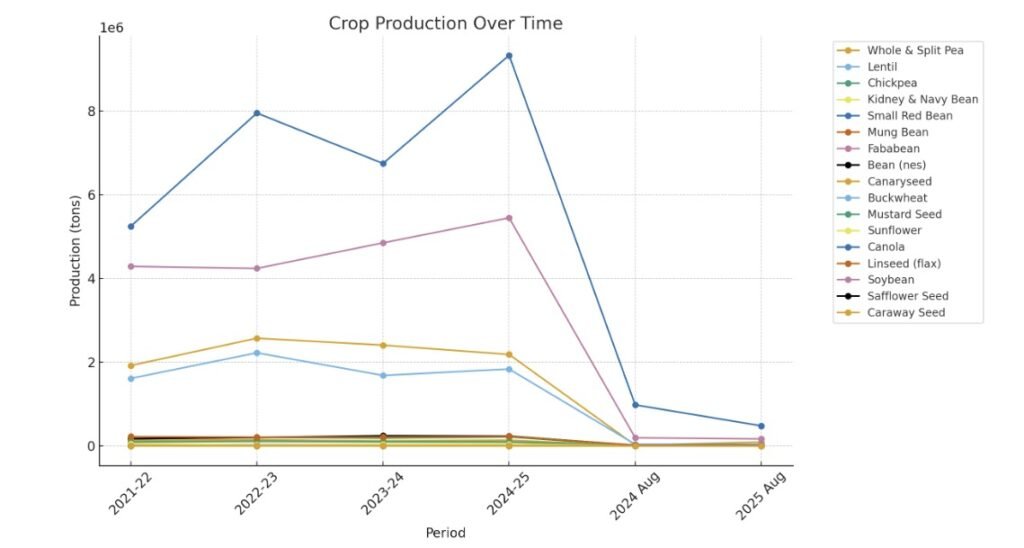

During the 2024–25 season, most Canadian crops performed better thanks to improved growing conditions. However, total grain stocks were still below last year and the five-year average, as strong exports reduced available supplies.

Even though production increased slightly, many prices came under pressure due to weaker world markets.

Looking ahead, the 2025–26 crop year is expected to be much stronger. Production of all major crops is projected to reach near-record levels, around 3% higher than last year and 8% above the five-year average. Pulses and special crops are expected to lead this growth, with output up by roughly 16%.

Better yields and stable seeded areas, especially across the Prairie provinces, are supporting this positive outlook. Harvesting is moving ahead of schedule in many parts of Western Canada. Still, prices for most crops are expected to remain below last year’s levels due to comfortable global supply.

Canada continues to play a leading role in the global lentil market. Demand for Canadian lentils stayed strong throughout the season, with Turkey, India, and the UAE remaining the top buyers. These countries show steady interest in both red lentils and green lentils, which make up the core of Canada’s pulse exports in September.

Within Canada, domestic use also showed a small increase as local processors and food manufacturers relied more on homegrown supply. By the end of the crop year, carry-out stocks rose moderately, a sign of stable production and consistent export flow.

Looking into 2025–26, Canadian lentils production is expected to expand. Saskatchewan will remain the leading producing province, followed by Alberta. With larger carry-in stocks, total supply could reach a new record, while exports are also projected to grow.

Although the global lentil supply is expected to rise, Canada’s reputation for quality and reliability continues to support strong demand for Laird, Eston, Crimson, and Dall (split red lentils).

Canadian Kabuli chickpeas also performed well this year. Export volumes reached record highs, mainly driven by solid demand from Pakistan and the European Union. This increase in movement shows how Canadian chickpeas have become a reliable choice for buyers looking for quality and consistency.

Domestically, production has been improving with better weather and higher yields, especially in Saskatchewan, which produces the majority of Canada’s chickpeas. However, because total supply increased faster than exports, ending stocks were higher by the close of the season.

For the upcoming year, production is forecast to rise again, supported by larger planted areas and improved yields. Exports are expected to remain steady, and prices may stay on the softer side due to larger world supply, especially from key producing countries.

Even so, Canada’s chickpeas maintain a good position in the global market, known for clean sorting, uniform size, and excellent quality standards that appeal to both retail and wholesale buyers.

https://agriculture.canada.ca/en

At Lord Agro Trade, we monitor weekly updates from Canada’s official market sources to provide our partners with the latest insights on Canadian lentils and chickpea prices. Check our updated price table below for more details.

https://lordagrotrade.com/lentils-price/

Canada Export Summary – August 2025

(metric tons)

Source Statistics Canada

https://www.statpub.com/