Gulfood

17 To 21 FEB 2025 | DUBAI WORLD TRADE CENTRE

We’re excited to see you at Gulfood 2025!

Gulfood

17 To 21 FEB 2025 | DUBAI WORLD TRADE CENTRE

We’re excited to see you at Gulfood 2025!

The global pulse market is entering the new season with strong production volumes, active trade flows, and shifting supply dynamics across key origins. Improved yields in major producing countries, combined with steady demand from traditional importing regions, are reshaping buying opportunities for the months ahead.

Below is a product-based overview highlighting the main market movements relevant to our international customers.

With solid production and active exports, Canada remains a dependable origin for long-term lentil sourcing.

Lentil trade activity remained active across multiple regions during the early part of the marketing year. Bulk shipments through licensed facilities reached around 160K MT in October, bringing cumulative seasonal movement to just over 410K MT. While last season started with faster movement, current volumes reflect a more balanced and structured export pace.

Turkey significantly increased its lentil imports during October, sourcing mainly from Kazakhstan and Russia, with Canada also maintaining a presence in this market. At the same time, Turkey’s own lentil exports strengthened, with Sudan, Iraq, and Algeria emerging as the leading destinations, each taking approximately 10K MT.

From Canada, lentil exports accelerated strongly into late fall. Total monthly movement reached around 270K MT, driven mainly by demand from India, followed by the UAE and Pakistan. This confirms Canada’s continued role as a reliable supplier to South Asia and the Middle East.

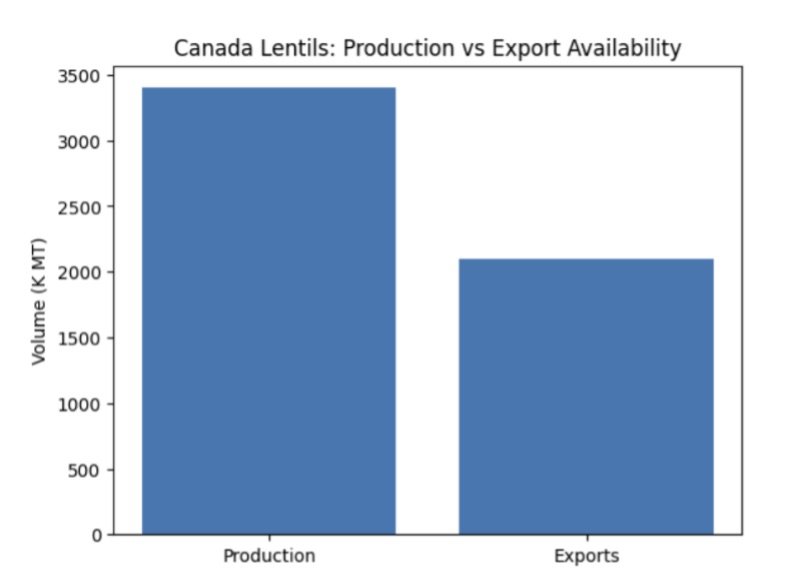

Looking ahead, Canada’s lentil production for the new season is estimated at approximately 3.4M MT, supported by both higher acreage and solid yields. Large green and red lentils together account for the majority of this volume. Quality across the crop is considered average, with a healthy mix of commercial grades available for export programs.

Canada’s lentil exports continue to be led by strong demand from India, followed by the UAE and Pakistan, reinforcing stable trade flows into South Asia and the Middle East.

Chickpea trade showed steady momentum across key origins. Turkey’s chickpea exports increased notably in October, reaching about 34K MT, with Iraq remaining the primary destination. Regional demand from neighboring markets such as Syria and Jordan also remained active.

In Canada, chickpea movement during early fall reached approximately 15K MT, with the United States, Pakistan, and Turkey as the main buyers. Exporters continued to focus on fulfilling nearby demand while managing quality variations across the crop.

Canadian chickpea production for the current season is estimated at just under 500K MT, marking one of the largest crops on record. While overall quality is mixed compared to last year, the supply base provides flexibility for different market segments, including processing and bulk destinations.

Dry bean exports from Argentina, particularly red beans, showed gradual improvement, with October shipments reaching just under 50K MT. Spain and Italy were the leading destinations, followed by Turkey, confirming consistent Mediterranean demand.

In Canada, dry bean production is estimated at around 440K MT, dominated by colored bean types. Ontario remains the key producing province, while Manitoba benefited from better yields. Export activity continues to focus on the United States and the EU, with supplementary volumes moving to Mexico and Japan.

Despite higher available supplies, Canadian dry beans remain well-positioned in premium food markets due to stable quality and reliable logistics.

| You can follow our website to access updated prices at the link |

Dry pea production expanded significantly this season, reaching approximately 3.9M MT, supported by higher yields and increased harvested area. Yellow peas continue to represent the majority of output, followed by green peas.

Export volumes are expected to remain close to 2.2M MT, with demand influenced by trade policies in key Asian markets. Nevertheless, interest from diversified destinations continues, and green peas are maintaining a clear value premium over yellow types.

As the season moves forward, Canadian lentil export activity continues to build, supporting timely sourcing decisions.

As we move closer to January and the year-end holiday period, shipment schedules across major origins tend to tighten. Higher seasonal demand, combined with limited vessel space, can influence logistics planning and overall costs.

At the same time, peak consumption months in Asia and the Middle East are approaching, which traditionally puts additional pressure on demand volumes. In this environment, early planning becomes a practical advantage.

At Lord Agro Trade, we work directly with Canadian farms and processors to help our customers manage timing, costs, and supply more efficiently. By aligning your purchasing plans early and staying close to our market offers, you can better control pricing exposure and secure reliable shipments during high-demand periods.

Source: https://agriculture.canada.ca/en